Mastercard New Payments Index: UAE Consumers Embrace Digital Payments

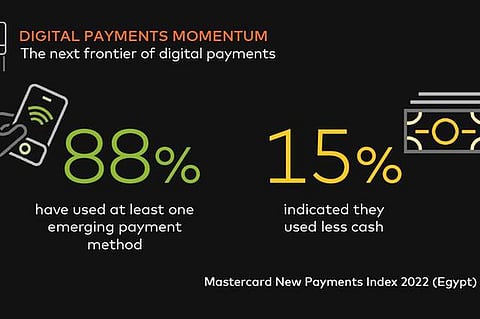

Mastercard’s New Payments Index 2022 found that 88% of people in the UAE have used at least one emerging payment method in the last year.

Of these, 39% used a tappable smartphone mobile wallet, 29% used BNPL, 20% used cryptocurrency and 18% used a payment-enabled wearable tech device.

Usage of digital payments increasing, use of cash declining

While traditional payment methods still have traction, 29% of consumers in the UAE indicated they used less cash in the past year.

By contrast, 66% of UAE users (compared to 61% globally) increased their use of at least one digital payment method in the last year, including digital cards, SMS payments, digital money transfer apps and instant payment services.

DEWA Digitally Integrates with More Than 70 Projects

While crypto use was low, 40% of cryptocurrency users in the UAE say they have used it more in the last year. These behaviors are expected to continue, with comfort and security key to growing adoption.

The Index confirmed security is top of mind when deciding what payment methods to use, globally and in the UAE (36%). In the country, security and rewards are main considerations, followed by promotions and ease of use.

“It is exciting to see the increased adoption of emerging payment methods and consumers’ eagerness to reap the benefits of the digital economy in the UAE and across the region,” said JK Khalil, Cluster General Manager, MENA East, Mastercard.

Receptiveness to more direct Account-to-Account (A2A) payments

Most consumers are open to direct account-to-account payment options, by linking their account to a merchant site for future purchases. 83% of UAE consumers using account-to-account payments have maintained or increased their usage in the last year.

Over half (55%) of UAE consumers feel safe using apps to send money to people or businesses from their phone. Five in ten (50%) are willing to share financial data information with apps to have access to payment tools that help them manage their money.

Biometrics offer convenience and security at checkout, though data access concerns remain

Consumers recognize the convenience that biometrics can offer, with 71% agreeing it is easier to make payments using biometrics than a card or device.

The potential for security optimization is also evident to consumers, with seven in ten agreeing biometrics tech for payments is more secure than two factor authentication.

Emerging payments have strongest traction among more digitally native generations

Younger generations have gone more digital in their purchasing and payments behavior, and their engagement in and usage of emerging digital payments engagement is accelerating at a faster rate than older audiences, the report stated.

Read More: Cyprus Becomes 1st EU Member to Join Digital Cooperation Organization